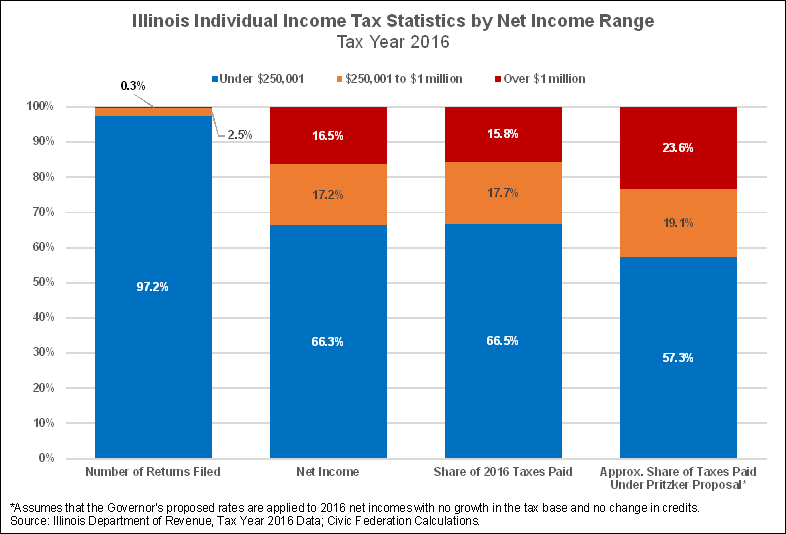

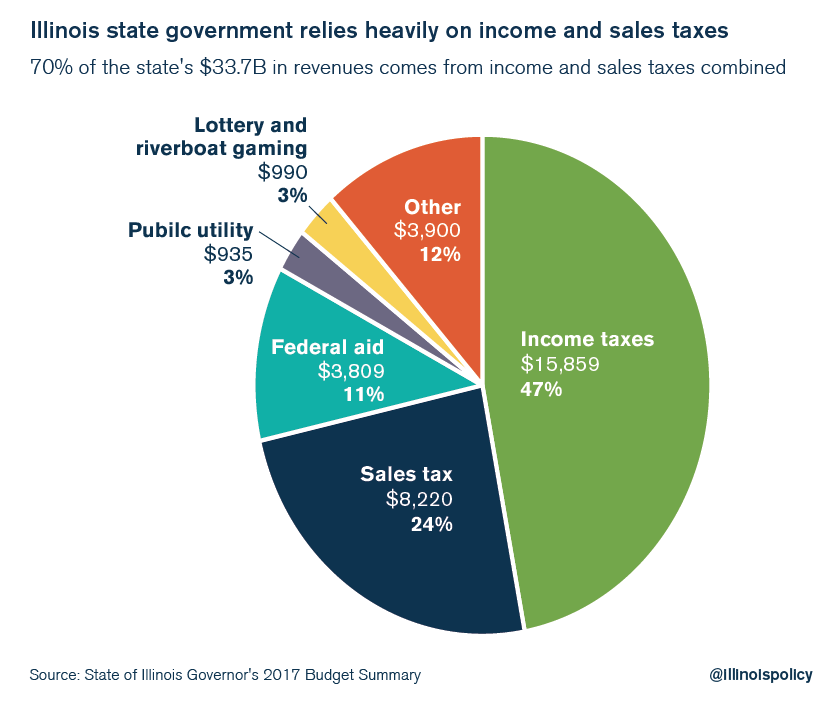

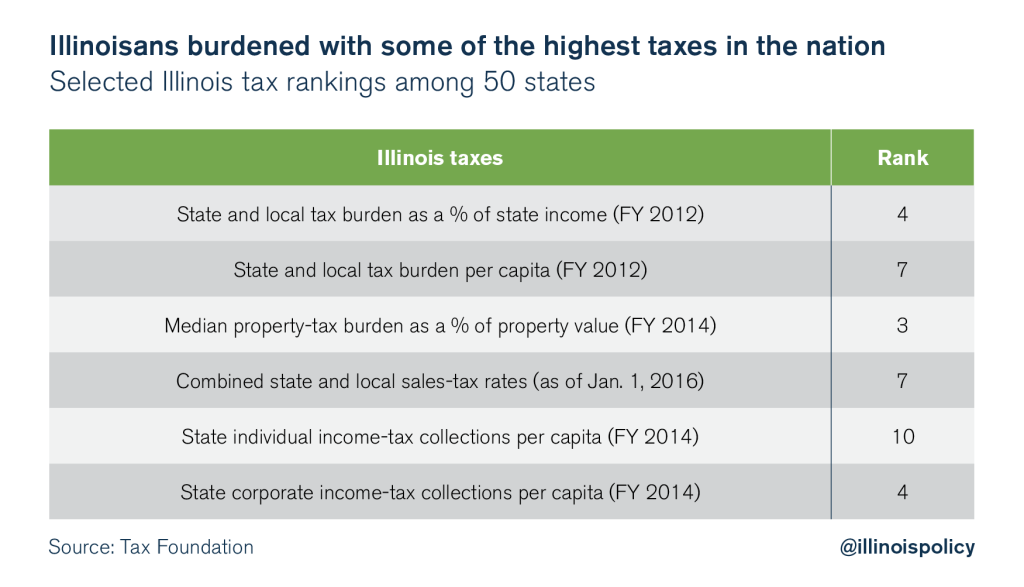

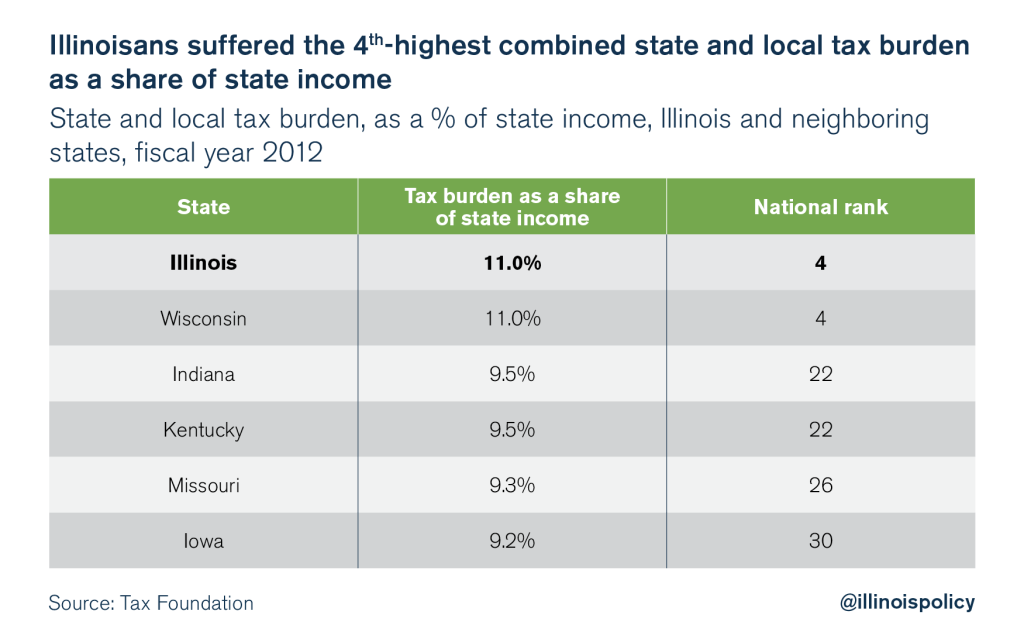

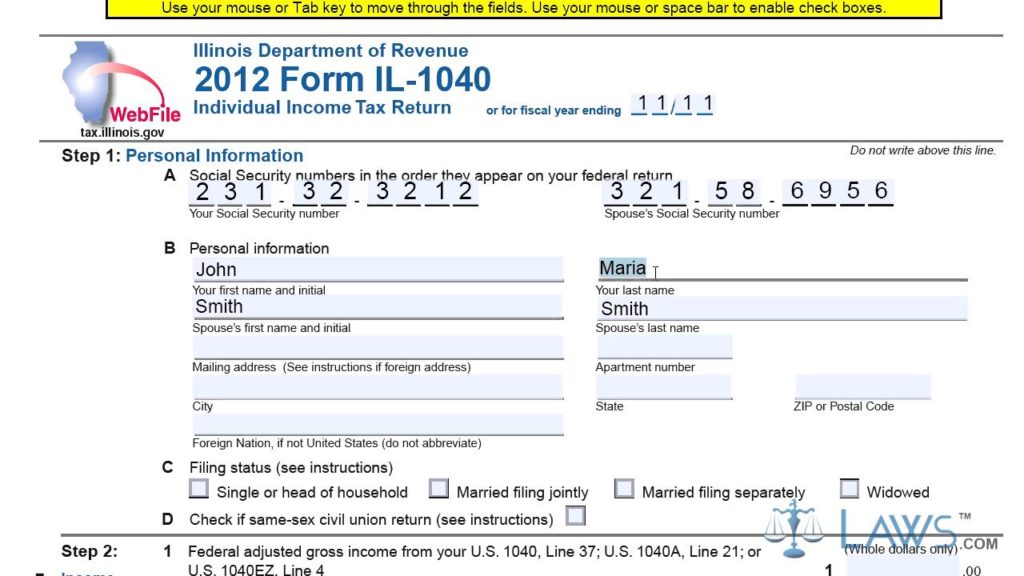

I have a monthly wage of $1,000, but need to pay tax at $220, so I just have $780 in the end. Is this kind of tax rate common in Illinois? - Quora

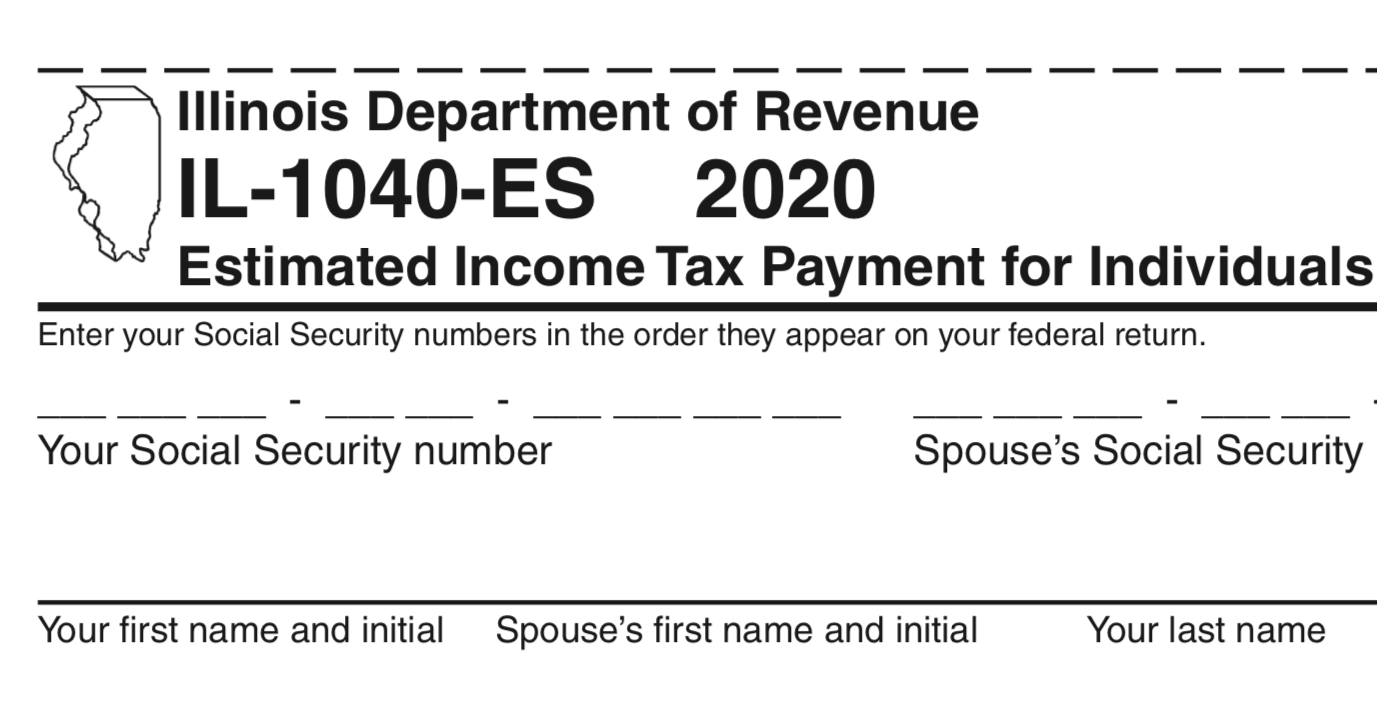

The Caucus Blog of the Illinois House Republicans: Calculating estimated state taxes during COVID-19 pandemic